Financial Tools

Financial Tools for Development

The Hastings Economic Development Corporation (HEDC) provides and connects businesses and individuals with a range of financial tools to support their growth and development efforts. Through its Business Revolving Loan Fund and Housing Revolving Loan Fund, HEDC offers gap financing to help expand local businesses and increase access to affordable housing within the Hastings community.

HEDC also serves as a hub for connecting you with a wide range of financial opportunities beyond the corporation—resources that can support your business or housing development goals. These include programs such as TIF, New Market Tax Credits, PACE funding, and more. At HEDC, we're committed to supporting your success—whether that means linking you to the right resources or actively assisting in your development efforts.

HEDC Revolving NDO Loan Fund

HEDC is dedicated to supporting the growth of both new and existing businesses in the Hastings community. Through its Revolving NDO Loan Fund, HEDC provides financing to businesses seeking to launch or expand operations in Hastings.

The Revolving NDO Loan Program is made possible by Nebraska Community Development Block Grant (CDBG) funds, awarded to the City of Hastings by the State of Nebraska. These funds are continually reinvested into the local economy, enabling HEDC to promote sustained business growth and community investment.

Businesses interested in this opportunity can apply for an NDO loan through a formal application and approval process.

Tax Increment Financing (TIF)

Tax Increment Financing (TIF) is a tool offered by the City of Hastings to encourage economic development within city limits. TIF can support a variety of project types, including residential, commercial, mixed-use, and industrial developments. It is typically used to help cover public costs associated with private development. Currently, there are eight designated TIF redevelopment areas in Hastings where this financing tool can be utilized.

Tax Increment Financing (TIF) works by freezing the property's current assessed value—known as the base value—for up to 15 years. Any increase in property value resulting from improvements is not taxed to the usual taxing entities during this period; instead, that tax increment is reinvested to help finance the redevelopment.

To qualify for TIF, a cost-benefit analysis must be completed as part of the application process. To learn more about how this is handled in the City of Hastings, please contact or visit the Community Redevelopment Authority (CRA).

PACE Funds

PACE stands for Property Assessed Clean Energy. This program, authorized by the Nebraska Legislature, allows municipalities to establish Clean Energy Assessment Districts. Within these districts, PACE financing can be used to support projects involving renewable energy installations, water conservation, energy efficiency, and resiliency improvements.

The City of Hastings has established a PACE program to assist eligible property owners seeking this type of financing.

PACE funding is generally intended for larger-scale commercial projects. To qualify, applicants must be undertaking a commercial real estate project within the city. The City of Hastings may finance up to 100% of eligible project costs, not to exceed $250,000 or 20–30% of the property's post-project value, whichever is less. If you're interested in pursuing this funding opportunity, please contact HEDC or the City of Hastings for more information.

SBA Loans

The Small Business Administration (SBA) is a federal agency that offers a wide range of support tools for small businesses and startups. One of its most well-known initiatives is the SBA Loan Program, which is designed to provide borrowers with extended repayment terms and lower interest rates. To help reduce the risk for lenders, SBA loans are partially guaranteed by the federal government.

Many local banks and financial institutions in Hastings, including larger regional lenders, offer assistance with SBA loans. If you're interested in exploring your SBA loan options, we encourage you to contact your local bank or reach out to HEDC for more information.

DED-CDBG Program

The Nebraska Department of Economic Development offers a valuable opportunity to attract additional funding—whether federal, state, or private—through its Community Development Block Grant (CDBG) Program. This program supports projects that benefit low- to moderate-income individuals, eliminate or prevent conditions of slum and blight, or address urgent threats to health and safety.

The Community Development Block Grant (CDBG) program provides funding to eligible projects that include a local match and remain in full compliance with CDBG guidelines throughout the project’s duration.

Recently, the City of Hastings has successfully secured CDBG funds for several key initiatives, including:

The Downtown Revitalization Project, aimed at improving the Business Improvement District

A Public Works Program supporting renovations at Revive Ministries

Another Public Works initiative focused on essential infrastructure development in Hastings

Additionally, Bruckman Rubber received CDBG funding in 2025 to support its facility and workforce expansion.

Assistance is available for those interested in applying. If you believe your project may be eligible for CDBG funding, please contact HEDC.

Site and Building Funds

The Nebraska Department of Economic Development offers a variety of incentives designed to promote economic growth across the state. One such initiative is the Site and Building Development Fund, which encourages improvements that enhance the industrial readiness of eligible sites and buildings.

To qualify for these funds, a project must be adopted by a dedicated development team and the local economic development organization.

If you have a potential site or project that you believe may qualify for these funds and are interested in applying, please contact HEDC for more information.

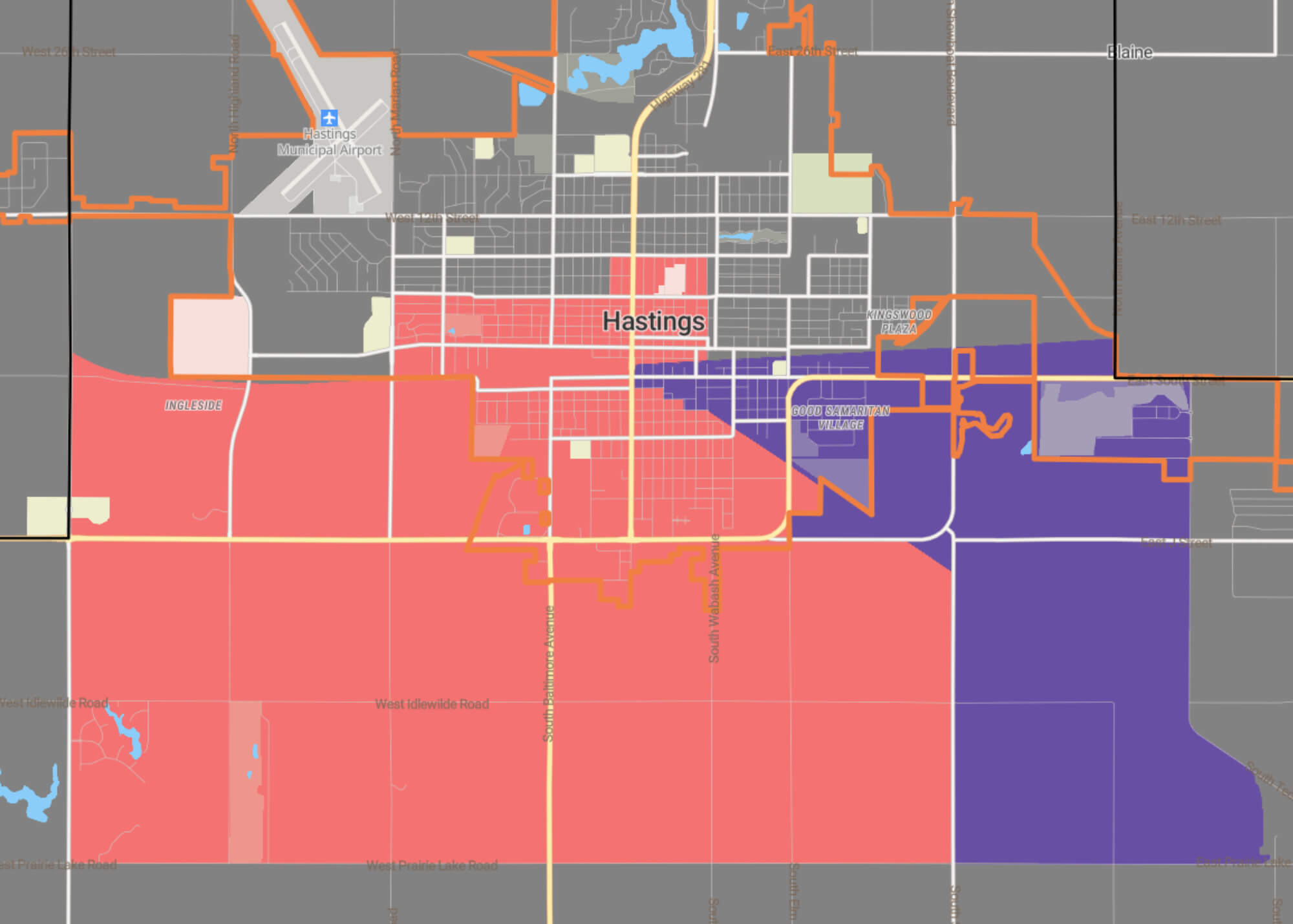

Purple and Pink Highlighted Areas Represent New Markets Tax Credit Zones in Hastings

New Markets Tax Credits

In 2012, Nebraska adopted the New Markets Tax Credit (NMTC) program through state legislation. This program enables communities to provide financing and investment—through tax credits—to businesses and projects that drive economic development in low-income areas. Hastings is located within a designated Opportunity Zone, making certain projects eligible for New Markets Tax Credits. To find out if your project qualifies, contact HEDC for more information and guidance.